If you are a trading enthusiast, you must know that a broker plays a major role in it. Finding a reliable and authorized broker is the key to success in trading. That’s where reviews like this come in handy.

This Loyal Primus review covers all the major aspects of the platform, including special features, pros and cons, leverage, account type, etc.

Basically, it can help you figure out whether Loyal Primus is a reliable broker or not! Learn more about Loyal Primus and if it fits your trading needs!

But first, check out a quick overview of Loyal Primus:

| FOUNDED IN | 2020 |

| HEADQUARTERS | St. Vincent and the Grenadines |

| REGULATORS | FCA and NFA |

| MINIMUM DEPOSIT | $15 |

| PLATFORMS OFFERED | MT4 |

| TRADING INSTRUMENTS | Indices, Commodities, Currencies, Future |

| ACCOUNT CURRENCY | AUD, CAD, CHF, JPY, NZD, USD, EUR, GBP, NZD, SGD, CNH, MXN, HKD, NOK, PLN, RUB, SEK, etc. |

| MAXIMUM LEVERAGE | 1:1000 |

| CUSTOMER SUPPORT | 24/7 |

| DEPOSIT OPTIONS | Local bank transfers, SurePay, Bitcoin. AWE Pay, |

| COMMISSION | Free |

| SPREADS | 0.6 PIPS |

| MOBILE TRADING | Yes |

| AFFILIATE PROGRAMME | No |

| CONTESTS AND BONUSES | Yes |

What is Loyal Primus?

Loyal Primus is an FCA-regulated broker with a leverage of 1:1000 pips. High leverage also equals high risks. It claims to be a transparent trading platform with high-quality services, but user reviews say otherwise.

Loyal Primus has certain unique features but also has negative customer reviews. We’ll break down the pros and cons of this broker in detail. Read ahead to learn whether or not this broker is trustworthy.

It has a global presence with 145 trading instruments and 3400 trades so far. Being a relatively fresh broker platform, it has provided decent services to traders. Loyal Primus is a No Dealing Desk (NDD) broker and does not require an intermediary and removes requotes.

The loyal primus minimum deposit is $15 for a standard account, which is a decent price. Moreover, it also provides a mobile trading option for your convenience.

Key Features of Loyal Primus

Let’s talk about some of the unique features offered by Loyal Primus.

Anti-Money Laundering Policy

This policy helps gauge any suspicious activities and prevent illegal financial transactions.

This feature provides extra safety and ensures that the transaction is legalized. AML policy prevents the use of its services for money laundering and other criminal activities

Loyalty Points

With Loyal Primus, you can earn loyalty points and claim exciting prizes. For every $1 deposit, you will gain 0.1 loyalty points. This is a unique feature provided by Loyal Primus to maintain traders’ interest and motivation.

Contests

Loyal Primus conducts trading contests with cash prizes. So, if you have a competitive edge, test it out by signing up for this platform.

Recently, it conducted a Chinese New Year contest with a total prize pool of $88,888. It provides traders with a great way to indulge in fun activities and gain money.

Market Analysis Tools

Loyal Primus offers a wide variety of tools like an economic calendar, market screener, etc. These tools can help you keep track of your performance and understand the market carefully. However, as per customer reviews, market analysis tools are not as efficient as claimed by the platform. To access the best market analysis tools check out AXI platform.

What Makes Loyal Primus a Good Broker?

Loyal Primus has several unique features that make it stand out. But to be a good trading broker, it must provide a high leverage, a wide range of assets and currencies, and so on. Now let’s see what Loyal Primus has to offer!

Leverage

Loyal Primus provides exceptional leverage up to 10000 pip. It will allow you to control a $1000 trade size for every $1. So even if the leverage size is high, it has more potential risks associated.

Moreover, such high leverage is not opted by experienced traders, especially with no negative balance protection. You should consider choosing Fortrade, which offers a comparatively lower leverage range.

Fees and Commissions

To open a Loyal Primus account, you must submit a minimum deposit of $15 for the standard account. If you wish to gain the deposit bonus, then you must make a minimum deposit of $50. Loyal Primus does not charge any deposit or withdrawal commissions.

Deposits and Withdrawals

Deposits and Withdrawals can be conducted through bank transfer, bitcoin, and other authorized financial transaction platforms like SurePay. You can access its 50% deposit bonus by following the deposit bonus regulations.

However, as per the customer experiences, the issues with withdrawals and deposits are a major concern for this broker. So, it’s best not to rely on this broker to trade with large assets.

What Currencies and Assets can you access?

Loyal Primus offers a sea of currency and asset options with distinct features. Even though investment in these assets is not fully reliable, let’s look at them in detail:

Commodities

- Commodities are good for trading CFDs, and Loyal Primus provides flexible leverage for commodities trading, but it is highly risky.

- Loyal Primus provides high liquidity on commodities trading and reduces the impact of potential inflation. However, high liquidity increases market instability.

- It has a 24-hour window for CFD trading, which increases the trading chances and improves performance.

- Oil is the most common commodity for CFD trading. The oil charges increase with economic growth, which boosts trading profits.

- CFD trading requires a minimum margin of 0.5%, meaning less investment and larger assets.

Cryptocurrency

- Loyal Primus includes 500+ cryptocurrency options

- Crypto transactions are much easier and less time-consuming than traditional trading. Be Loyal Primus’s issues with transactions can lead to scams, so be aware!

Metals

- Loyal Primus offers trading on metals, especially gold and silver.

- Metal trading can be conducted on platforms like the London Metal Exchange, Shanghai Gold Exchange, or New York Mercantile Exchange (NYMEX).

- Metal trading is safe and irrelevant to political and economic instability.

- It has no credit risks and provides hedging opportunities which gives exposure to investors.

- Loyal Primus allows you to trade on silver, gold, and platinum CFDs without buying the metals.

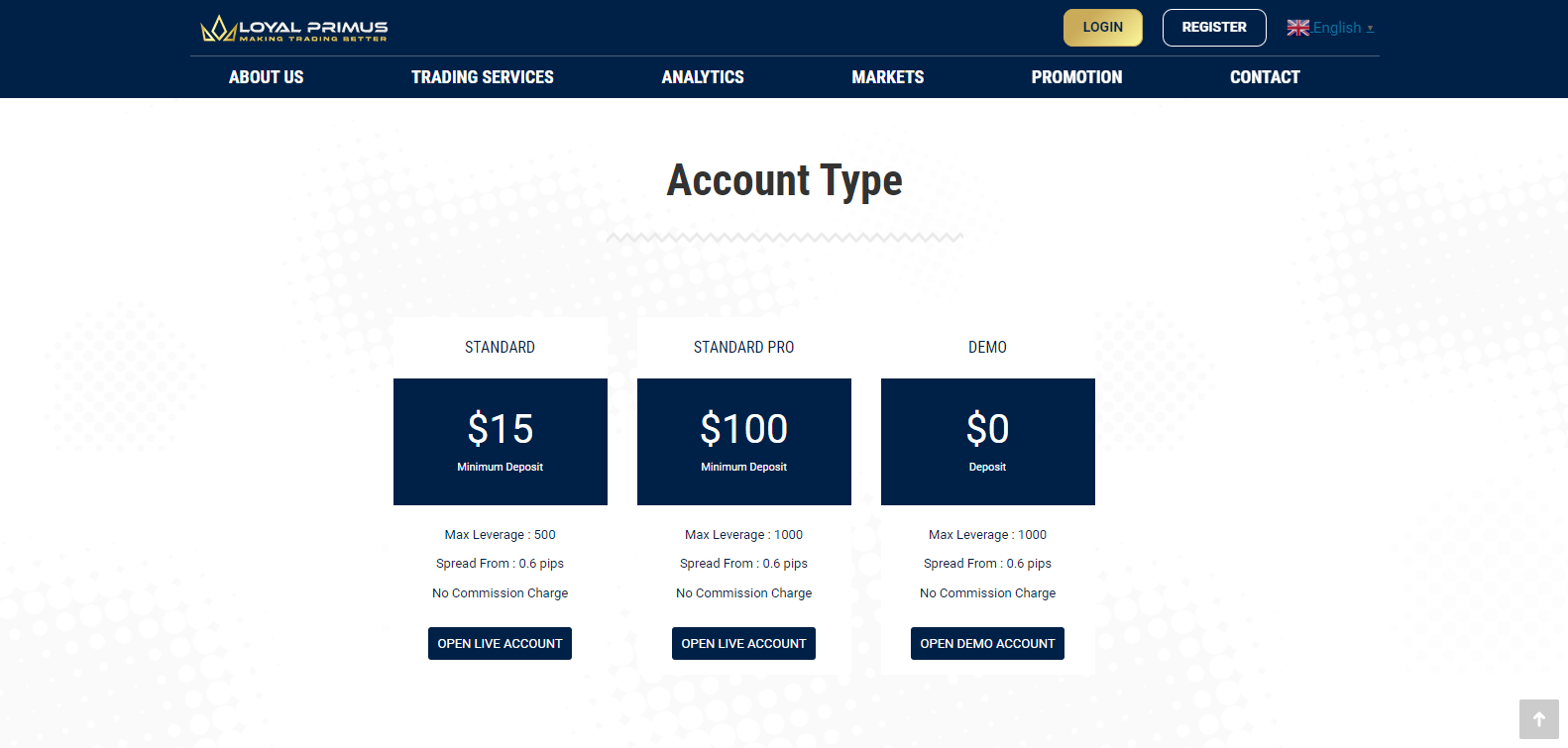

Account Types by Loyal Primus that you must know

Loyal Prime offers three basic account types: demo, standard, and standard pro. Each account offers a high leverage and low spread. An overview of each account type is as follows:

| Standard Pro | Standard | Demo Account | |

| Leverage | 500 | 1000 | 1000 |

| Spread | 0.6 pip | 0.6 pip | 0.6 pip |

| Commission | No commission | No Commission | No Commission |

Why should or shouldn’t you choose Loyal Primus?

You should choose Loyal Primus because it provides raw spreads, a wide range of assets and currencies, maximum leverage, and competitive spreads.

It is a No Dealing Desk Broker, which eliminates the intermediary and removes requotes. Offers services on both desktop and mobile.

You shouldn’t choose Loyal Primus because it has bad customer reviews. It has been accused of scams and fraud. People have also registered complaints about withdrawal issues. If you’re exploring alternatives, you might want to check out Novatech.

So, if the features offered by Loyal Primus match your trading needs, you can opt for it. But beware of potential scams and learn risk management techniques.

Pros And Cons of Loyal Primus

| Pros | Cons |

| High leverage | Limited educational resources |

| Wide variety of trading currencies and assets | Customer service only through email |

| Commission free trading | Limited information on withdrawal and deposit options |

| Available on the MT4 platform | |

| Multiple Account Types | |

| Minimum Deposit |

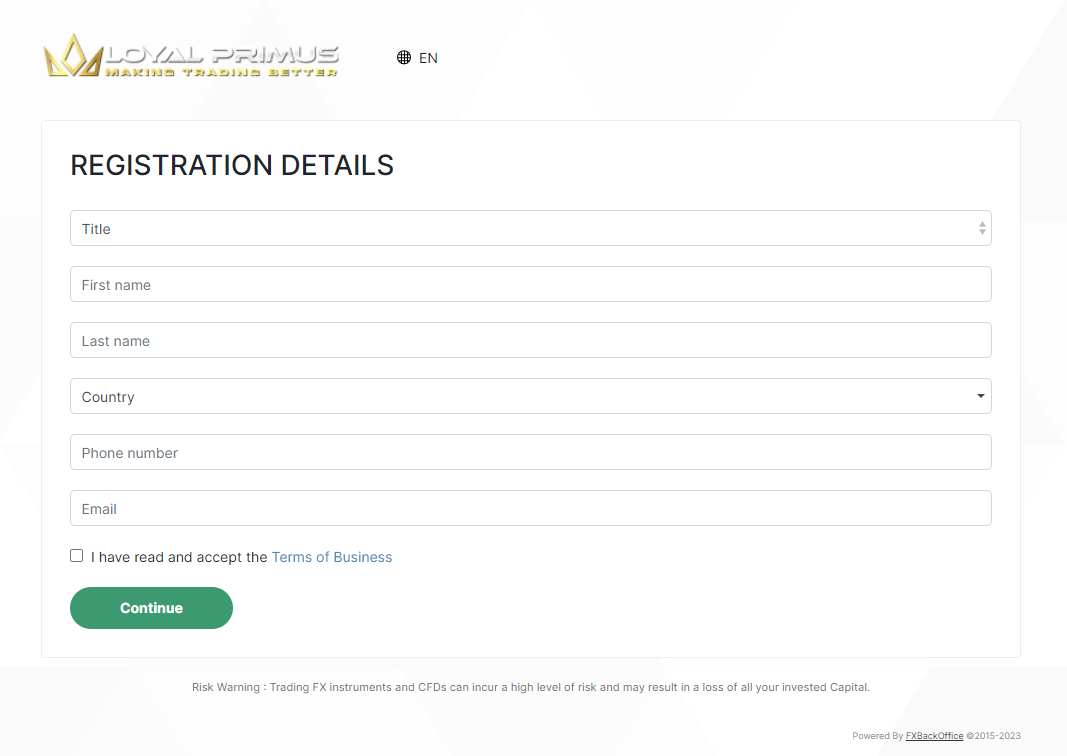

Steps to open a Loyal Primus account

Opening a Loyal Primus account is fairly easy. Follow to below steps, and you’ll have an active trading account.

Step 1: Create an Account

Open the official website of Loyal Primus, register yourself, enter relevant details, and your account will be created.

Step 2: Install the App

You can access trading much more easily by installing the app from the official website. Just open the app and log into your account.

Step 3: Deposit Funds

To begin trading, you are required to deposit a minimum amount into your trading account. You can deposit with just one click on Loyal Primus’s official website. This speeds up the process and makes it hassle-free.

Step 4: Choose Symbol

After you have created your account, you have to choose between the two listed symbols, all symbols or favourites.

Step 5: Volume

Volume is an important aspect of trading. Thus, the next step involves customizing or selecting your trading volume per your trading goals.

Step 6: Start Trading

Now that you have set up your trading aspects, you are all set to start trading!

Is Loyal Primus Regulated?

Loyal Primus claims to be regulated under the Financial Service Authority or FCA with registration no. 26626 BC 2022. However, we have found out that the regulation can not be trusted. If you wish to find a reliable FCA-regulated broker, you can opt for Triumph FX.

Loyal Primus lacks transparency about trading terms and conditions. Also, the mentioned registration no. is not identified to be owned by Loyal Primus. So don’t buy everything mentioned on the official website.

Loyal Primus Customer Service

Loyal Primus offers 24/7 customer support. You can ask your queries through the official website or contact them through email ID [email protected].

It offers very limited sources for customer support, which can be a concern when a trader requires immediate help.

Is Loyal Primus Secure?

Loyal Primus can be considered safe, but it has received negative reviews regarding scams, withdrawal issues etc. The regulation of Loyal Primus is likely to be fake, which makes it prone to risks and scams.

So avoid trading with Loyal Primus and be aware of any scams. You can reach out to Loyal Primus’s customer service for any help or queries.

Does Loyal Primus Offer Bonuses?

Yes, Loyal Primus offers a deposit bonus of up to 50% of the deposit amount. But it requires you to deposit a minimum amount. The deposit bonus rules are as follows:

- You have to deposit a $50 minimum amount to gain access to bonus offers

- You will only be eligible to earn the deposit if you don’t have any outstanding amount left in your trading account.

- The maximum credit offered by Loyal Primus is $300. You can not deposit more than $600.

- Your bonus application can be rejected at any time by the broker platform

- If your position hits stop out, then the bonuses will be liquidated

Since the broker can not be trusted with financial transactions, it’s best to avoid adding an extra deposit to claim a bonus which is not guaranteed.

Sources: Loyal Primus Review

- WikiFX: It is a trusted Chinese broker review website. As per its review, Loyal Primus is rated 3.4 out of 10, which is below the average ranking.It claims that the regulatory status of Loyal Primus is abnormal. Hence the risk associated is much higher. Moreover, bad customer reviews have also led to a bad rating.

- Brokers view: It finds the lack of information on the website and lack of transparency to be problematic. As per the review, Loyal Primus has a high leverage which could be risky in the long run.

- The Forex Review: The Forex Review is a reliable platform that offers reviews on various brokers. It has rated Loyal Primus 1 out of 5, which is significantly low.

Overall, the ratings convey that Loyal Primus is not a secure and reliable platform for trading and consists of substantial risks for traders.

Is Loyal Primus Better Than Raceoption?

XTB is a moderate-risk forex broker headquartered in Poland. It offers competitive spreads, leverage, and various trading assets. Check out Raceoption to learn more information on account types and trading assets.

I have compared Raceoption with Loyal Primus as they both have certain similarities.

| Loyal Primus | Raceoption | |

| Leverage | 1:1000 | 1:500 |

| Spread | 0.6 pip | 1 pip |

| Fees and Commission | Min deposit $15, 0 commission | $10 to $20 depending on area |

| Regulation | FCA and NFA | N/A |

| Broker Type | No Dealing Desk Broker | CFD |

| Account Type | It offers three types of accounts: Standard, Standard Pro and Demo Account | Bronze, Silver, Gold, VIP Accounts |

| Trading Platform | MT4 | Broker’s proprietary web platform, Raceoption mobile platform |

| Trading Assets | Indices, Commodities, cryptocurrency, futures | Forex assets, stocks, indices, and binary options. |

| Customer Support | 24/7 customer support, but only available through email services. | 24/5 |

| Review | The reviews and ratings of this broker are very negative. Customer reviews claim issues with withdrawals and transactions. | Raceoption has a reasonable review with a 6.5 out of 10 rating from Traders Union |

Conclusion

Loyal Primus has potential as a forex broker platform, but it is highly unreliable. The user experience with Loyal Primus has been polarizing. People have had issues with withdrawals and transactions.

Although Loyal Primus is a relatively friendly broker platform. I recommend you to not use this trading platform because of the large number of negative reviews. Since trading is an unpredictable market, it’s easier to be extra safe and cautious.

FAQs

Is Loyal Primus a Good Broker Platform?

Loyal Primus has a mixed reputation. While it offers high leverage and a variety of trading options. There are also some concerns raised by users, including withdrawal issues and scams. You should be cautious and thoroughly research before trading with them.

Where is Loyal Primus Based?

Loyal Primus is headquartered in St. Vincent and the Grenadines.

Is Loyal Primus Available in India?

Yes, Loyal Primus is accessible for traders in India

What is the leverage provided by Loyal Primus?

Loyal Primus offers leverage up to 1:1000, allowing you to control larger positions with a smaller investment. However, high leverage comes with higher risks.

How Many Trading Instruments Does Loyal Primus Provide?

Loyal Primus offers 145 trading instruments, including indices, commodities, currencies, and futures.

Is Loyal Primus’ Regulation Authentic?

Loyal Primus claims to be regulated by the Financial Conduct Authority (FCA) and the National Futures Association (NFA), but this is likely to be false.

User reviews indicate concerns about its legitimacy. It is also not found on the FCA official website

Why is Loyal Primus a Bad Company?

Loyal Primus has received negative reviews regarding issues with withdrawals, transactions, and scams, which raise concerns about its reliability and customer service.

Does Loyal Primus Provide Customer Services?

Yes, Loyal Primus offers 24/7 customer support. However, customer service is only available through email, which might be a drawback for some traders seeking immediate help.

What is the minimum deposit of Loyal Primus?

The minimum deposit for a standard account with Loyal Primus is $15, making it easily accessible for traders with limited funds.

What are Loyal Primus’ Loyalty Points?

Loyal Primus offers a unique feature where traders can earn loyalty points for every deposit made, which can later be redeemed for prizes.