Introduction

The Forex Trading phenomenon is spreading like wildfire, and many people want to start forex and investment as a side hustle to earn some extra bucks. However, people need help with how to start the trading process.

Choosing a legitimate and reliable forex broker is the first step towards being a trader, but this selection process requires thorough research and careful analysis. Interactive Brokers is a renowned forex trading broker offering excellent services at a lower price. In this interactive brokers review, We have conducted a thorough analysis of the broker to help you make an informed decision.

What is an Interactive Brokers?

Interactive Brokers LLC is a large electronic trading platform and multi-asset trading broker headquartered in Greenwich, Connecticut. You can trade with multiple assets, including interactive brokers futures, options, forex, cryptocurrency, stocks, ETFs, etc. The broker offers trading with low trading fees and high-quality trade execution, along with a wide range of research and technical analysis tools.

Is Interactive Brokers Regulated?

It is regulated under SEBI with the registration number NZ000217730 and National Securities Depository Limited with the IN-DP-602-2021 CIN-U67120MH2007FTC170004 licence number. The broker has an offline headquarters in 502/A, Times Square Building, Kurla Road, Andheri East, Mumbai.

Overall, the broker is a reliable trading platform as SEBI and NSDL are some of India’s renowned trading financial regulators.

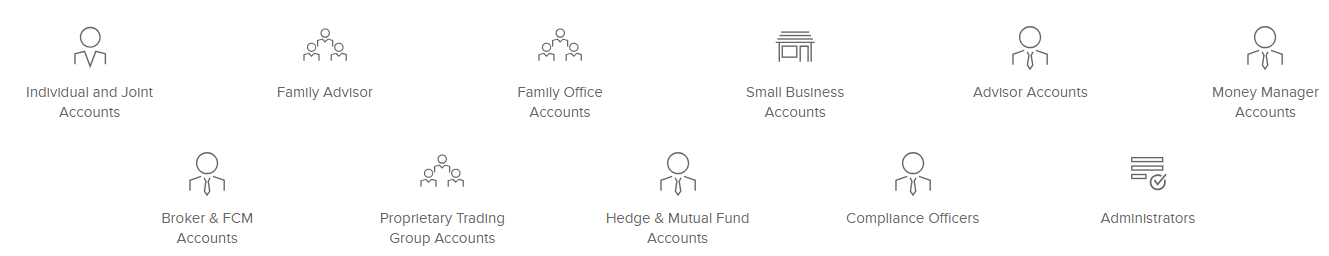

Account Types Offered by Interactive Brokers

The broker offers account types that cater to different designations and experiences and cover many aspects, including small businesses, family advisors, individual and joint accounts, etc. Check out the account types in detail:

| Account Name | Client Description | Account Description | Margin |

| Small Business Accounts | Small Business Owners | The business owners or account holder has complete access | Portfolio, Reg T, and Cash Margins are available |

| Individual and Joint | The account holders can either be one or two-person | Assets are held in a single account, accessible to single or both account holders. | Same as Small Business Accounts |

| Family Advisor | An advisor with fewer than 15 clients | The main account is connected to individual client accounts in which the account holder handles most things. | It is the same as Small Business Accounts, |

| Family Offices, | and Someone who manages the family finances. | The main account is linked to the client accounts, and the charges vary for different accounts. | Same as Small Business Accounts. (Managers are allowed to split trades) |

| Money Manager: | A registered advisor who handles the clients of another advisor. | A separate account is created for each client, but only the manager can trade on behalf of the clients. | It depends on the leading advisor. |

| Advisor Accounts: | A company or an individual that manages money for other people. | The main account is linked to client accounts. | Cash, Reg T and Portfolio are available. |

| Broker and FCM | Broker or FCM should be the advisors. | The main account is linked to the client’s accounts. | Like the small business owner account |

| Propriety Trading Group | A cooperation, partnership or company, | Single or multiple accounts can be owned. A master. It is the user, is the one who manages the account | the same as the small business owner account. |

| Hedge and Mutual Funds | An investment manager who manages single or multiple accounts | The master account is connected to the individual accounts | Same as the small business owner account |

| Compliance Officers | Organizations | A single account is linked to multiple employee accounts | N/A |

| Administrators | Third-Party Administration Services | A single account is linked to multiple advisors, hedge funds and propriety trading groups in this account type. | N/A |

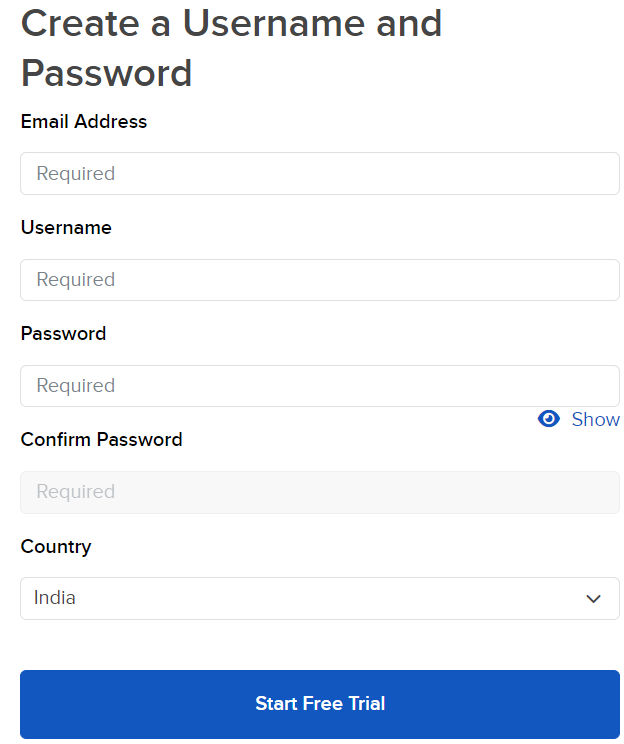

How to Create an Interactive Brokers Account?

To create an interactive brokers account, follow the steps mentioned below:

- Go to the website sign-up page.

- Enter your details like email ID and a create user name and password.

- Now you have an active IB account and can start your free trial.

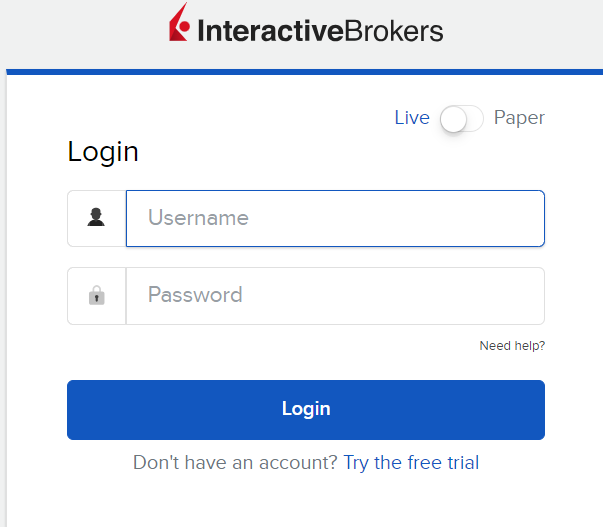

- Go to the broker’s login page and enter your credentials.

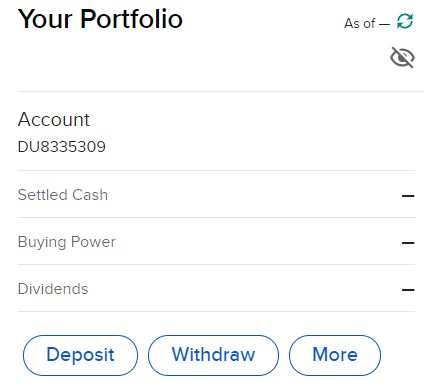

- After you enter your login credentials, you’ll be directed to your trading dashboard, which will provide options to place a trade, deposit and withdraw. You can deposit funds into your account and start trading with IB.

Trading Platforms For Interactive Brokers

The IB broker does not offer the usual trading platforms like MT4 and MT5; you can opt for Capitalix broker. But the broker does offer advanced propriety platforms and mobile applications for convenient tradings. Interactive Broker’s forex and asset trading can done through the following platforms:

Traders Workstation

The Interactive Broker offers a propriety trading platform called Traders Workstation, which you can download from the broker website. The Interactive Brokers API or Application Program Interface operates under the Trader Workstation and offers traders the platform and assets required for trading.

Traders Workstation offers TWS Mosaic, which provides traders with features like order management charts, watchlists, and portfolios and allows easy access to trading. This platform offers the following features:

- Real-time news, market data and research tools from renowned services like Reuters, Dow Jones, flyonthewall.com, etc.

- Access to financial information from Reuters Worldwide Fundamentals.

- Event Calendar.

- Risk management tools like risk navigator, modern navigator and options analytics.

IBKR Mobile App

The broker also has a mobile application to download interactive brokers app from the broker website and practice convenient trading.

How to Download the IBKR App?

- Go to the interactive brokers website.

- Scan the QR code provided by the broker.

- You’ll be directed to the Play Store or Apple Store window.

- Click on download, enter your credentials to log in and start trading on IB through a mobile app.

Interactive Brokers API

It APIs allow traders to build customer trading apps catering to their needs and preferences. In this platform, you can access a wide range of assets, including stocks, futures, options, currencies, bonds and funds of 33 countries covering 150 global currency markets.

Through this platform, you can also build automated and commercial trading softwares. The IB Smart Routing feature offered by the broker lets traders searcg best firm stocks, assets and more.

Trader Workstation API

This feature is part of the IB API platform ans allows traders to gain automated trading strategies and monitor their accounts and portfolios in real-time. You can also develop applications of advanced softwares like C++, C#, Java, Python, ActiveX RTD or DDE.

Interactive Brokers Client Portal API

The client portal API or REST API is another platform you can connect via the propriety broker platform TWS. It allows you to track, manage and monitor your IBKR account, place orders and view trader’s positions. The platform can stream orders on the WebSocket application. You can access this platform through a leased line, the internet or cross-connect.

Excel API

With this broker platform, you can access the features of Excel and enjoy the flexibility of the TWS API platform simultaneously. You can connect this platform through the propriety broker platform, place orders, view trades and positions, and access market data. With the accessibility of Excel, this platform lets you build applications or softwares on Java, DDE, ActiveX and RTD.

FIX

With this feature, traders can leverage the broker’s high-speed order routing and extensive market research tools. You can connect with this platform through the propriety platform offered by IB.

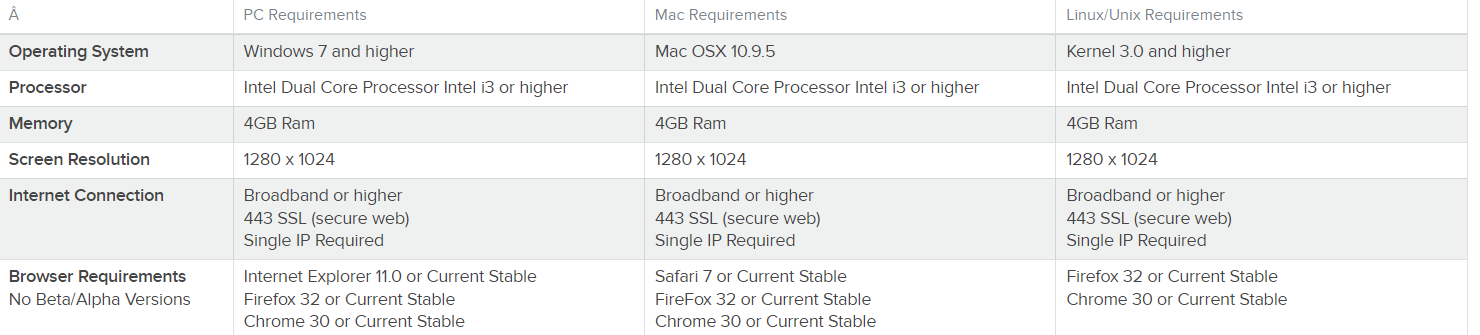

Interactive Brokers WebTrader

The webtrader platform is also offered by IB broker but is only available on Windows, Mac, and Linus/Unix. So, to trade with Webtrader, ensure that your operating systems meet the broker’s requirements. Check out the detailed criteria for using the Webtrader platform:

Interactive Brokers Paper Trading

The broker also allows traders access to paper tarding to practice tarding, develop strategies, and perfect trading skills without the risk of losing money. Through the broker’s paper tarding feature, you can enjoy the following benefits:

- Test New Strategies

- Access training tools like charts, market depth, options pricing, risk analytics and more.

- Understanding market dynamics

- Access to paper account statement

- Permission to run IB API trading solutions and strategy.

Deposits and Withdrawals

There is no fixed Interactive Brokers minimum deposit amount. You can deposit and withdraw as per your wish and convenience. You can deposit or withdraw your funds through a wide range of payment options, including:

- Bank Wire: The transactions through bank wire transfer will take 1-2 business days, but it can vary depending on your bank. When you deposit money into your account, notify the broker and contact the bank to send a wire. You can withdraw the funds using an Interactive Brokers debit card.

- Mail: Another way to deposit or withdraw funds is by mailing a paper check to the broker. The check will reach the broker in 6 business days; there is no limit on the amount of money unless the bank requires it.

Interactive Brokers Fees and Commission

Although the broker does not have a limit over the number of deposits and withdrawals, it does charge certain fees. We have made a list of the Interactive broker’s commissions.

| Account Type | Commissions |

| Broker Account | $10,000 for the first 8 months, $2000 per month after the 8 months period |

| Trader’s Workstations and TWS API | $500 per month |

| REST API | $500 per month |

| FIX | $1500 per month for the first session, then $1000 per month |

Key Features Offered by Interactive Brokers

- You can access 600+ investment services

- 320+ Research Services

- 450+ Technology Services

- 200+ Administrative Services

- 40+ Business Services

- The interest rates goes up to 4.83% USD

- Access to 150 global markets across countries

- Interactive Brokers is an award-winning broker who won awards for professional trading, global fintech, best forex, and best online broker in 2023.

Trading Tools Offered by Interactive Brokers

IB offers a wide range of free trading tools which can be used to trade options, and futures, place different orders etc. You can access these tools after registering yourself with the broker.

- Accumulate/Distribute Algo

- Fundamentals Explorer

- Bracket Orders

- Trade in Fractions

- Strategy Builder

- Impact Dashboard

- Write Options Tools

- Rollover Options Tool

- Exit Strategy

- Mobile Options Trading

- TWS Layouts

- Custom Indexing

- Bond Search Tools

- Mutual Funds Tools

- IB Risk Navigator

- Rebalance Portfolio

- Client Portal

- Short Securities Available

- Allocation Order Tools

- FX Trader

- Speed Trader and much more

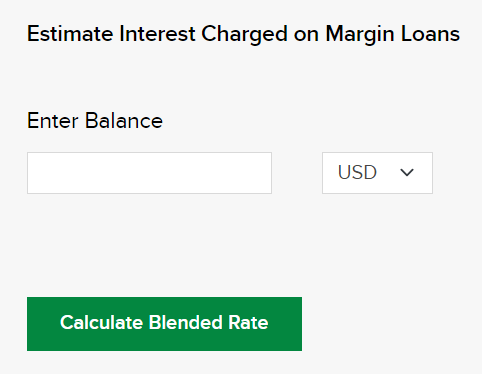

What is Interactive Brokers Margin Trading?

Margin trading for securities involves borrowing money to buy an interactive broker’s stock, and for commodities, margin trading includes staking personal money as collateral. This can be a great source for making money in a short period of time. The interactive broker’s margin rates start at 0.75% of the margin loans. You can calculate your margin loan and interest per the interactive broker’s margin requirements with the calculator on the website.

Educational Resources Offered by Interactive Brokers

It offers a wide range of educational resources, including a Traders academy, news, webinars, glossary etc. Let’s look at the educational materials in detail:

- Access financial courses on stocks, futures, options, bonds, etc.

- Attend live webinars on trading, which provide a chance to interact with experienced traders. You can register for the webinars through the broker website.

- The platform also offers regular podcasts where each trading topic is discussed daily in detail and provides traders with great insight.

- You can also read articles on forex trading the broker offers and gain important insights into trading and navigating the broker platform.

Interactive Brokers Customer Service

The broker offers robust customer support through various sources, including email and mobile. The interactive broker’s contact details are given below:

- Interactive Brokers Phone Number: +91-22-61289888

- Fax: +91-22-61289898.

- Email: [email protected] / [email protected]

TradeStation vs Interactive Brokers

| Interactive Brokers | TradeStation | |

| Fees | $0 | $0 |

| Commission | $0.60 per contract for options, $1.50 per contract for futures | $0.65 per contract for options, $0.85 per contract for futures |

| Assets | Stocks, Mutual funds, Cryptocurrencies, CDs, Options, Futures, Currencies, ETFs, Bonds, | Stocks, Mutual Funds, ETFs, Options online and OTCBB |

| Order Types | 100+ order types and algo are available | Access to multiple order trading simultaneously |

| Technical Indicators | Yes | Yes |

| Market Analysis Tools | Includes charts, bar, candlestick charts | Includes bar, dot, lines. Candlestick charts and more |

| Regulation | Yes | Yes |

Interactive Brokers vs Fidelity

| Interactive Brokers | Fidelity | |

| Deposit Fee | $0 | $0 |

| Inactivity Fee | No | No |

| US Stock Fee | $1 | $0 |

| CFD Spreads | 0.4 | N/A |

| Regulation | Yes | Yes |

| Investor Protection | Yes | Yes |

Conclusion

IB broker is a reliable and regulated broker offering a wide variety of features, assets like options, futures, crypto-forex, many trading tools and active customer support. It can be a great choice for a broker for traders, family/official advisors, money managers, small business owners, etc.

FAQs

Is Interactive Brokers Safe?

The Interactive Brokers is regarded as a secure broker. It is governed by National Securities Depository Limited (License IN-DP-602-2021 CIN-U67120MH2007FTC170004) and SEBI (registration number NZ000217730). It is a trustworthy trading platform since it complies with strict regulatory requirements.

Who owns Interactive Brokers?

Under the ticker sign, IBKR is listed for public trading on the Nasdaq Stock Market. Thomas Peterffy, who serves as Chairman and CEO, started the corporation.

What is Interactive Brokers?

The biggest electronic trading platform, with many asset classes, is based in Greenwich, Connecticut. It offers many trading products, such as stocks, ETFs, futures, options, currency, and cryptocurrencies.

How to buy t-bills Interactive Brokers?

The general procedures for purchasing Treasury notes (T-bills) via Interactive Brokers are as follows:

- Open your Interactive Brokers account and log in.

- Open the trading platform by navigating.

- Look over the possible instruments for Treasury bills.

- Choose the T-bill that you like to buy.

- After entering the quantity, submit your purchase.

Where is Interactive Brokers’ Headquarters located?

The US headquarters of Interactive Brokers are located in Greenwich, Connecticut. Furthermore, 502/A, Times Square Building, Kurla Road, Andheri East, Mumbai, is the address of its offline office.

How do you close an Interactive Broker’s account?

The general procedures to terminate your account are as follows:

- Open your Interactive Brokers account and log in.

- Go to the area for account management.

- Seek for the withdrawal or account closure option.

- To submit a request to close your account, follow the procedures displayed on the screen.

How to use Interactive Brokers?

The general procedures for using Interactive Brokers are as follows:

- On the Interactive Brokers website, register for an account.

- Enter the trading site and log in.

- Examine the marketplaces and instruments that are available.

- Analyse and conduct market research.

- Enter order information to place trades.

- Keep an eye on market and portfolio fluctuations.

- Make use of the trading tools that Interactive Brokers provides.

- Consult Interactive Brokers’ official resources or contact support

How to trade forex on Interactive Brokers?

To use Interactive Brokers for FX trading:

- Access your account by logging in.

- Go to the section on FX trading.

- Choose the currency pair that you wish to deal in.

- Enter the transaction information, such as the order type and amount.

- Place and confirm your currency deal.

- Ensure you apply risk management techniques and have a basic understanding of FX trading.

How to buy bonds on Interactive Brokers?

Using Interactive Brokers to Purchase Bonds:

- Access your account by logging in.

- Get on the exchange website.

- Look for the particular bonds that you wish to purchase.

- Choose the bond and input the required amount.

- Select the desired order type, then validate the purchase.

What are the Interactive Brokers Options Trading Fees?

The Interactive Brokers options fees change based on the geographical location. The minimum fee starts at $0.25 per contract in the United States, simultaneously, the charges increase in Mexico, reaching up to 40 Mexican dollars per contract.

What are Interactive Brokers CFDs?

CFD trading involves guessing the asset price without actually buying or selling the asset. You can access many CFDs on Interactive brokers, including stocks, indices and commodities.

Which one is better, Interactive Brokers vs TD Ameritrade?

Both brokers have a wide range of assets and benefits that traders can use, but TD Ameritrade has a simple and user-friendly platform compared to Interactive brokers. So TD Ameritrade is better for novice traders, whereas Interactive brokers can be the top choice for experienced traders.