The Forex market is experiencing remarkable growth day by day, attracting numerous enthusiastic individuals who aspire to build a sustainable career through currency trading. These aspiring traders are driven by their passion to learn, practice diligently, and maintain consistency in their efforts.

However, a prevalent issue that these novice traders encounter is the challenge of identifying a trustworthy broker. While there are numerous options available, regrettably, some of these brokers are fraudulent and prioritize their own interests over those of the traders.

Therefore, it becomes crucial to conduct comprehensive research on brokers before making any investments. To simplify this process for you, we have prepared an in-depth and comprehensive review of HankoTrade Brokers.

Here’s an in-depth overview of HankoTrade review:

| FOUNDED IN | 2018 |

| HEADQUARTERS | Seychelles |

| REGULATORS | Not Regulated |

| MINIMUM DEPOSIT | $10 |

| PLATFORMS OFFERED | MT4, MT5 |

| TRADING INSTRUMENTS | CFD, Litecoin, indices, bitcoin forex pairs, cash, ethereum, Ripple, 62 forex pairs and commodities |

| ACCOUNT CURRENCY | EUR, USD and CAD |

| MAXIMUM LEVERAGE | 1:500 |

| CUSTOMER SUPPORT | 24/5 |

| DEPOSIT OPTIONS | Ripple, Bitcoin, Ethereum, Litecoin , and Bitcoin Cash |

| COMMISSION | $2 Per $100K Lot |

| SPREADS | 0.0 PIPS |

| MOBILE TRADING | Yes |

| AFFILIATE PROGRAMME | Yes |

| CONTESTS AND BONUSES | Yes |

What is HankoTrade?

Hankotrade operates as a Straight-through processing brokerage firm catering to the needs of both retail and professional traders. They specialize in offering trading opportunities involving CFDs on various assets, including currencies and cryptocurrencies. Hankotrade’s headquarters are situated in Port Harcourt City, within the Rivers State of Nigeria. It’s important to note that this brokerage operates without regulation.

We Recommend HankoTrade for

HankoTrade positions itself as a versatile trading platform suitable for individuals of varying expertise levels. The platform offers a wide range of account options to cater to different trader preferences. The STP account option is designed with simplicity in mind, ideal for newcomers to trading. It incorporates commissions into the spread, making it easy to understand. On the other hand, the ECN and ECN Plus accounts are tailored for experienced traders and scalpers who are well-versed in advanced trading strategies.

HankoTrade also offers an Islamic Account specially crafted for Muslim traders, providing a commission-free and SWAP-free trading experience.

Furthermore, HankoTrade demonstrates its commitment to supporting and assisting novice traders by providing an extensive array of educational tools on its website. This dedication to offering educational resources highlights their commitment to helping traders enhance their skills and knowledge in the world of financial markets.

Is HankoTrade A Regulated Broker?

Hankotrade is officially based in the Seychelles; however, the broker’s website does not currently display any regulatory information. While the absence of regulation might raise concerns for some traders, it enables Hankotrade to offer specific trading conditions, products, and services that could be restricted for regulated brokers due to stringent regulatory requirements.

The broker explicitly mentions that its services are not intended for use in jurisdictions where doing so would violate local laws or regulations.

Leverage

Utilizing leverage in trading grants you the ability to initiate a trade with a substantially larger value than your initial deposit.

When leverage is employed, it signifies that the majority of the required capital is contributed by your broker while you provide a deposit that represents only a fraction of the overall trade size, enabling you to open a significantly larger position.

The maximum leverage ratio offered by HankoTrade is 1:500.

What Type of Trading Accounts Does HankoTrade Offer?

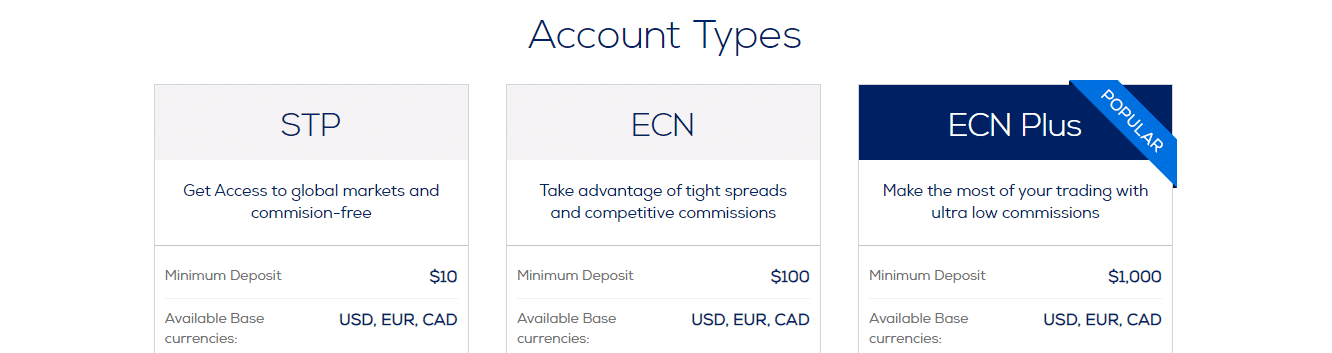

HankoTrade offers mainly three types of Accounts to trade in. Apart from these three accounts, it also offers an Islamic Account for Muslim Traders, that is, Swap free and commission-free.

| ACCOUNT TYPES | STANDARD | ECN | ECN PLUS |

| MINIMUM DEPOST | $10 | $100 | $1,000 |

| AVAILABLE BASE CURRENCY | USD, EUR, CAD | USD, EUR, CAD | USD, EUR, CAD |

| SPREADS FROM | 0.7 Pips | 0.0 Pips | 0.0 pips |

| LEVERAGE | 1:500 | 1:500 | 1:500 |

| COMMISSION | Zero | $2 per side per $100k traded | $1 per side per $100k traded |

Demo Accounts

HankoTrade offers demo accounts that give you the opportunity to gain familiarity with the broker’s platforms and services without exposing yourself to any financial risk. When you are confident and prepared, you can seamlessly transition to a live account whenever you choose.

How To Open An Account On HankoTrade?

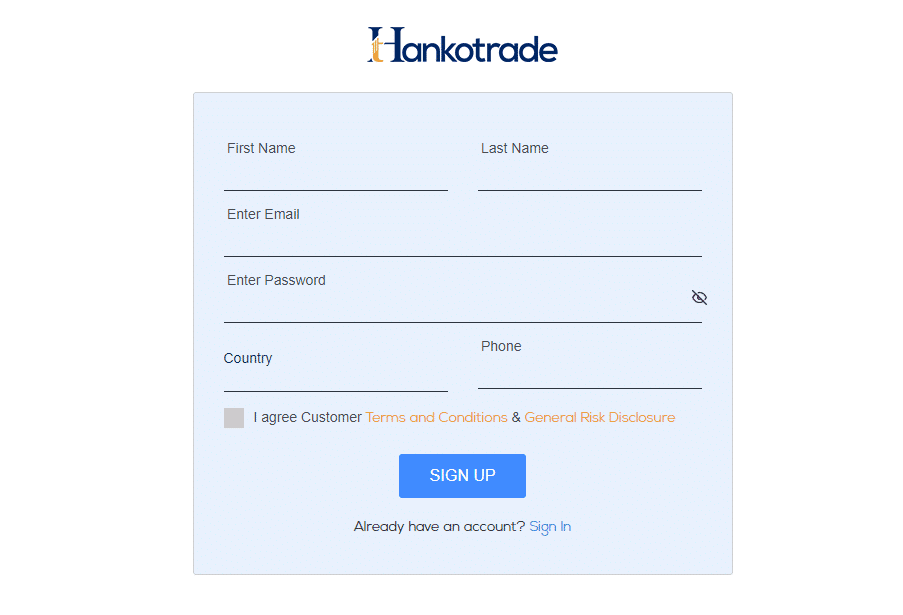

STEP 1: Click on “Register” located at the top right corner of the website.

STEP 2: Fill out the given form and the required information.

Pros and Cons of Hankotrade Review

Similar to other brokers, HankoTrade too has its advantages and disadvantages. Here are some of these which we discovered while reviewing the broker:

| PROS | CONS |

| Negative Balance Protection | Only Crypto Funding |

| Adherence to Anti-Money Laundering principles’ requirements. | Not Regulated |

| Spreads starting from 0.0 pips | Little Research Resources on the Website |

| Low Trading Fees | |

| Range of Trading Tools | |

| Free Demo Accounts | |

| Customer Service Team is friendly. |

HankoTrade Market Instruments

Forex Major Pairs: Over 62 forex pairs

Server Time Zone: GMT+3 during summer and GMT+2 during winter.

Session break is between 00:00 to 00:05

Commodity/ Energy Pairs: Metals, including gold and silver, and other Energy products, such as WTI Crude and UK Oil.

Server Time Zone: GMT+3 during summer and GMT+2 during winter.

Session break is between 00:00 to 01:00 server time.

CryptoCurrency: Bitcoin, Ripple, Ethereum, Bitcoin Cash

Server Time Zone: GMT+3 during summer and GMT+2 during winter.

CFD Indices: 11 major international stock indices.

Server Time Zone: GMT+3 during summer and GMT+2 during winter.

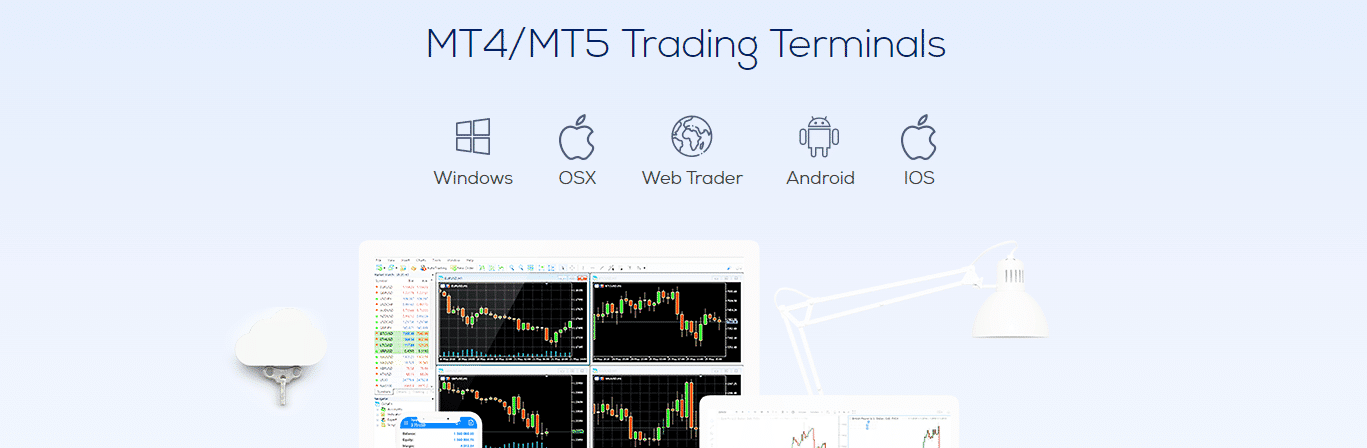

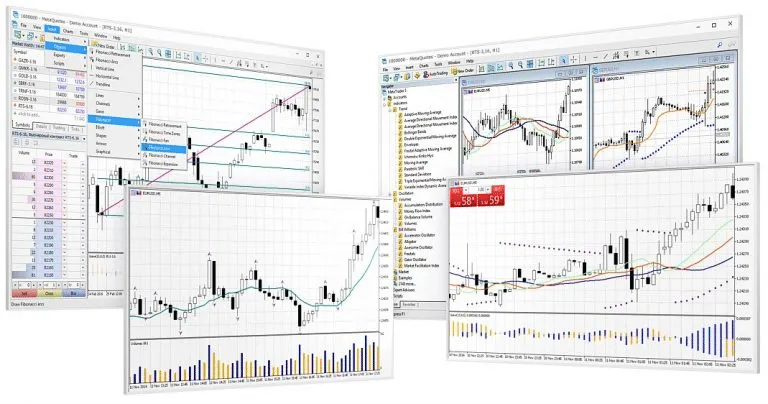

Trading Platforms

HankoTrade offers several types of Trading Platforms to traders.

WebTrader

Hankotrade offers a web-based trading platform that grants convenient market access to traders of all skill levels. This platform is accessible around the clock from anywhere in the world, empowering traders to execute well-informed and timely transactions.

MetaTrader4

Recognized as among the most dependable, effective, and extensively utilized trading platforms, MT4 stands out as an excellent choice for Forex trading. It offers various execution modes, encompassing market orders and pending orders.

MT4 features the largest array of trading applications globally.

- Fast Trading

- No re-quotes and No partial fills.

- Around-the-Clock Access

- Windows

- Web Trader

- Android

- IOS

- Trade with Benefits

- Run EA effortlessly 24*5

MetaTrader5

Meta Trader 5 is a flexible trading software equipped with numerous exceptional, innovative, and user-friendly features designed to enhance your trading performance.

- 21 Types of Different Time Frames

- There are a total of 11 distinct minute chart options and 7 diverse hourly time frame choices available, in addition to the standard daily, weekly, and monthly time frames. This extensive range allows for more comprehensive and nuanced market analysis.

- Additional Pending Orders

- Buy-Stop Limit and Sell-Stop Limit

- Enhanced Technical Analysis

- 38 Technical Indicators

- 44 Analytical Objects

- Bitcoin Account

- Trade on Bitcoin Denominated accounts

- USD, CAD and EUR

Mobile App

The mobile app of HankoTrade is designed for user-friendliness, offering push alerts and notifications, the ability to trade directly from charts, as well as signals and graphs optimized for both tablets and mobile devices.

Educational and Research Resources

HankoTrade lacks Education and Research Resources on its website. The broker should have these resources so that novice traders can learn and trade effectively.

For Educational purposes, resources and learning, traders can opt for other traders such as Capitalix, Equiity, TradeEU.

Fees and Commission

The STP profile is the sole commission-free account option, offering minimal spreads starting at 0.7 pips. On the other hand, the Hankotrade ECN account comes with a $4 commission per round lot turn, alongside raw spreads that start at 0 pips. Comparatively, the ECN Plus account is more cost-effective, featuring a $2 commission per round lot turn, also accompanied by raw spreads starting at 0 pips.

During our use of Hankotrade, we encountered spreads of 0.7 pips for the GBP/USD pair and 0.8 pips for the USD/EUR pair. There are overnight swap fees for positions, although these charges are waived on the Islamic account.

| ACCOUNT TYPE | SPREAD | WITHDRAWAL COMMISSION |

| STP | $7 | No |

| ECN | $0 | No |

| ECN PLUS | $0 | No |

Deposits and Withdrawals with HankoTrade

Steps to Deposit with HankoTrade:

- Login to the client portal.

- After login, go to the side menu and click on ‘Deposit.’

- From the deposit menu, choose ‘Cryptocurrency.’

- Fill out the payment request with your trading account ID and specify the cryptocurrency you wish to deposit.

- Click ‘Proceed.’

- On the following screen, you’ll find details of the crypto wallet.

- To complete the transaction, either use the QR code provided or the information displayed on the screen.

- You can check your deposit history and transaction status by visiting the ‘Deposit’ section within the client dashboard.

Withdrawals with HankoTrade:

- The minimum withdrawal amount stands at $50, and the brokerage firm typically processes withdrawal requests within a 24-hour timeframe.

- In cases where the withdrawal request remains unconfirmed for 48 hours, it may be declined. Also, the company reserves the right to withhold fund withdrawals if the account lacks sufficient margin or if the wallet details are inaccurately provided.

- While deposits do not require verification, if the withdrawal amount exceeds $5,000, the company may request proof of identity as part of the process.

- It’s important to note that compensation for transfer fees may not be granted if there has been no activity on the trading account.

- Withdrawals of funds are exclusively available in cryptocurrency.

Reliability and Security

HankoTrade provides traders with a dependable and trustworthy trading experience, notably through the MetaTrader suite, a well-established industry standard. The incorporation of these platforms underscores HankoTrade’s dedication to delivering reliable and widely acknowledged tools to its clients.

HankoTrade’s exceptional customer service bolsters its reliability. With extensive availability, traders can promptly resolve any potential concerns, guaranteeing a smooth trading experience. This blend of dependable platforms and top-tier customer support solidifies HankoTrade’s standing as a dependable option for forex traders.

User Experience

After thorough analysis and in-depth research, it became evident that HankoTrade has garnered favourable ratings from reputable sources, underscoring its strong reputation as a reliable and respected broker within the forex trading industry.

Upon reviewing their website, we observed that it offers a seamless and user-friendly interface, enhancing the overall experience for traders.

Customer Support

With Hankotrade, customers can access the support team through various means, including LiveChat, email, or a contact form available on the website. However, it’s worth noting that there are no phone numbers provided on the website for direct phone support.

Pros and Cons of Customer Service

| PROS | CONS |

| Quick response on LiveChat and Call | A dedicated Mobile App for Customer Service is not available |

| Support Available in Multiple Language | Lacks Social Media Customer Support |

| Multiple Contact Options | 24*5 service |

HankoTrade Vs Pepperstone Vs GoMarkets Vs Easy Markets Vs XTB- A Comparison

| Broker | 🏛️ Regulation | 💰Min. Deposit | 💱 Spreads | 📈 Leverage | 👍Demo Account | Website |

| HankoTrade | Not Regulated | $10 | 0.0 pips | 1:500 | Available | https://hankotrade.com/ |

| Pepperstone | FCA (UK), ASIC (Australia), DFSA (UAE) | $0 | 1-1.3 pips | 30:1 | Available | https://pepperstone.com/en/ |

| Go Markets | FSC Mauritius | $200 | 0.0 pips | 500:1 | Available | https://www.gomarkets.com/en/ |

| Easy Markets | CySIC, ASIC | $100 | 0.7-1.3 pips | 1:30 | Available | Visit here |

| XTB | UK Financial Conduct Authority | 0 | 0.1 pips | 30:1 | Available | https://www.xtb.com/int |

Conclusion

Hankotrade operates as an ECN broker situated in Seychelles, offering a diverse selection of financial instruments for online trading through the user-friendly MetaTrader platforms, available on desktop, web, and mobile devices. These instruments encompass Forex, Cryptocurrencies, Indices, and Commodities.

The broker presents an array of account choices, commission-free trading, narrow spreads, swift execution speeds, support for cryptocurrency deposits, 24/7 customer assistance, and a comprehensive set of valuable trading tools.

My personal experience using them has been quite satisfactory, with timely and hassle-free deposit and withdrawal processes. Consequently, I see no issues in relying on them for my day trading activities.

FAQs

How would you assess Hankotrade as a broker?

Hankotrade could be characterized as a moderately reliable broker, receiving an overall rating of 5 out of 10. The broker provides a maximum leverage ratio of 1:500 and requires a minimum deposit of $10/R160. It is regulated by the FSA.

What amount do I need to deposit as a minimum with Hankotrade?

The minimum deposit amount for Hankotrade varies depending on your account type. For an STP account, it is $10, while for an ECN account, it’s $100.

Which countries are not eligible to use Hankotrade’s services?

As stated in its terms of use, Hankotrade welcomes clients from all nations except the UK and certain heavily sanctioned countries and regions.

Is HankoTrade restricted in India?

No, HankoTrade is restricted in India.

What is the location of Hankotrade’s headquarters?

Hankotrade is based in Seychelles.

What are the approved forex trading regulations in India?

Forex transactions in India are overseen by the RBI (Reserve Bank of India. Trading with the Indian Rupee (INR) is allowed in pairs involving the US Dollar, Japanese Yen, British Pound, and Euro.

Is Hankotrade permitted in the United States?

Hankotrade primarily functions outside the United States and has minimal or no presence within the U.S. However, it is actively seeking and accepting funds from U.S. customers and providing a product under the jurisdiction of the Commodity Futures Trading Commission.

How many forex brokers are prohibited in India?

In September of the previous year, the central bank introduced an ‘Alert List’ comprising 34 unauthorized forex trading platforms. This list was also revised in February, and it now comprises 56 entries.