Key Highlights

- Intraday trading strategies provides a potential to supplement savings in the face of growing prices, but it comes with inherent dangers.

- Understanding market dynamics, choosing appropriate stocks, and implementing effective strategies are critical.

- Candlestick patterns, breakouts, reversals, and momentum trading are all viable strategies. However, success necessitates discipline, risk management, and lifelong learning.

- Thorough analysis, prudent fund allocation, avoiding overtrading, and making effective use of indicators are all important concerns.

- By following strategic recommendations and responding to market fluctuations, intraday traders can improve their chances of success.

Introduction

Intraday trading provides a chance of adding to normal savings, which frequently fall short of meeting our needs, especially as inflation rises. Investing in the stock market or mutual funds can be profitable, but there are potential risks that must be carefully considered. Intraday trading, a strategy for purchasing and selling equities on the same day, is gaining popularity.

To be effective, you must be patient, disciplined, and have experience. Despite market volatility, following strategic guidelines can result in big profits. In this article, we will look at the key concepts of intraday trading, as well as methods and vital suggestions for success.

What is Intraday Trading?

Intraday trading refers to buying and selling equities on the same day. The idea is to earn quickly from these trades while avoiding the risks associated with keeping stocks for an extended period.

Traders seek to profit from daily price changes while reducing their exposure to potential market downturns.

How to do Intraday Trading?

To begin Intraday Trading, select the top Intraday stocks. Intraday trading has a higher level of risk than normal trading. Investors may suffer losses due to market volatility, such as unexpected price movements. Here are some critical measures to choose the top intraday stocks:

Select the Right Stocks

Volatility:

- Choose stocks with medium-to-high price volatility. This creates opportunities to profit from price variations on the same day.

- Avoid equities with daily price changes of greater than 3%, since they might cause considerable losses due to unexpected swings.

- Be cautious of adverse market conditions, as increased volatility can magnify losses.

Focus on Liquidity

Liquidity:

- Choose equities that are highly liquid, which means they may be purchased and traded without having a substantial impact on their price.

- Highly liquid stocks allow you to enter and exit deals quickly, which is important for intraday trading.

- Mid- and small-cap stocks frequently provide the necessary liquidity and have high volatility, making them ideal for intraday trading.

Analyse Trade Volume

Trade Volume Index:

- Follow the transaction volume index of the stocks you’re interested in. This indicator measures the number of shares exchanged and reflects market activity.

- A high trade volume index indicates substantial market interest, either in terms of demand or supply, which is fueled by major events or corporate performance.

- Trading stocks with high transaction volumes can help you capitalise on significant price swings, allowing for better profit potential through both buying and selling.

Check Correlation

Correlation to Benchmark Index:

- Invest in stocks that have a strong correlation with a benchmark index, such as the S&P 500 or the NASDAQ.

- Stocks with strong correlation tend to follow the overall market trend, making it easier to forecast price moves based on index performance.

- Benchmark indices include top-performing corporations, and their overall trend can shed light on the likely path of associated stocks.

- During economic downturns, this association may deviate, so stay watchful and adjust your plan accordingly.

Observe Market Trends

52 Week High and Low Analysis:

- Analyse equities’ 52-week high and low values to better understand their cyclical movements and wider market trends.

- This research assists in evaluating whether to take short or long positions based on past performance and current market conditions.

- Use the findings of this study to make sound trading decisions, anticipating probable market moves and altering your strategy to optimise profits.

Intraday Trading Strategies

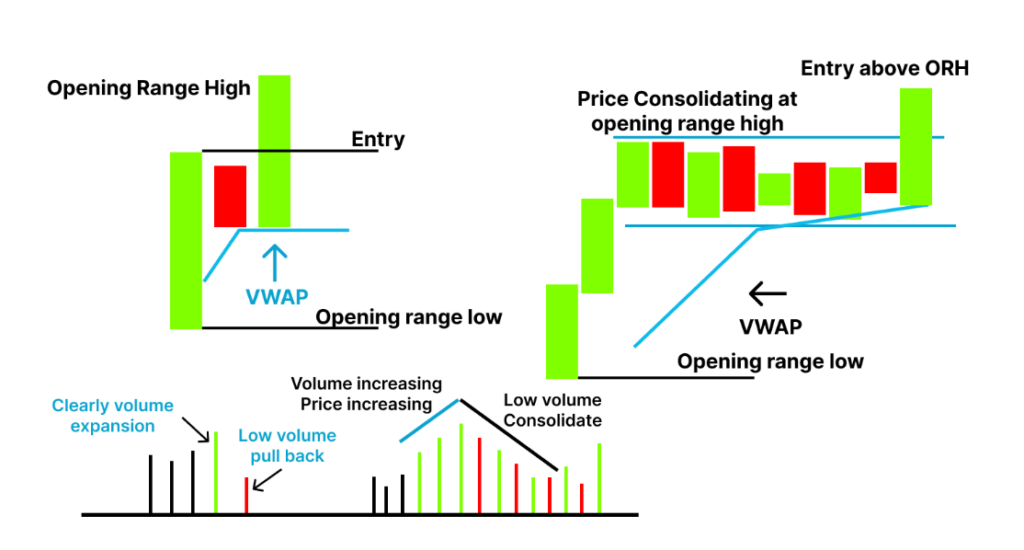

Intraday trading requires strong timing and market knowledge. A successful strategy includes technical analysis, practical implementation, the use of indicators, and effective risk management. In this section, we’ll go over intraday trading techniques for novices to get started.

With consistent practice, you can become proficient at this. Always set stop-loss limits to protect yourself from losses. Choose a trading style that suits your needs and personality. Here are a few successful trading tactics employee:

Moving Average Crossover Strategy

- A moving average crossover occurs when two moving average lines cross one another. This tool helps you determine whether to buy or sell.

- Moving averages follow trends with some delay, so they may not reflect the exact top or bottom prices, but they can help you identify the majority of a trend.

- When the lines cross, it could indicate that the trend is going to change, presenting an excellent entry option.

- Crossovers are most effective in turbulent or trending markets, but less so when prices are stable.

- Hence, moving average crossovers can indicate when a new trend begins or an old one ends, providing unambiguous entry and exit opportunities

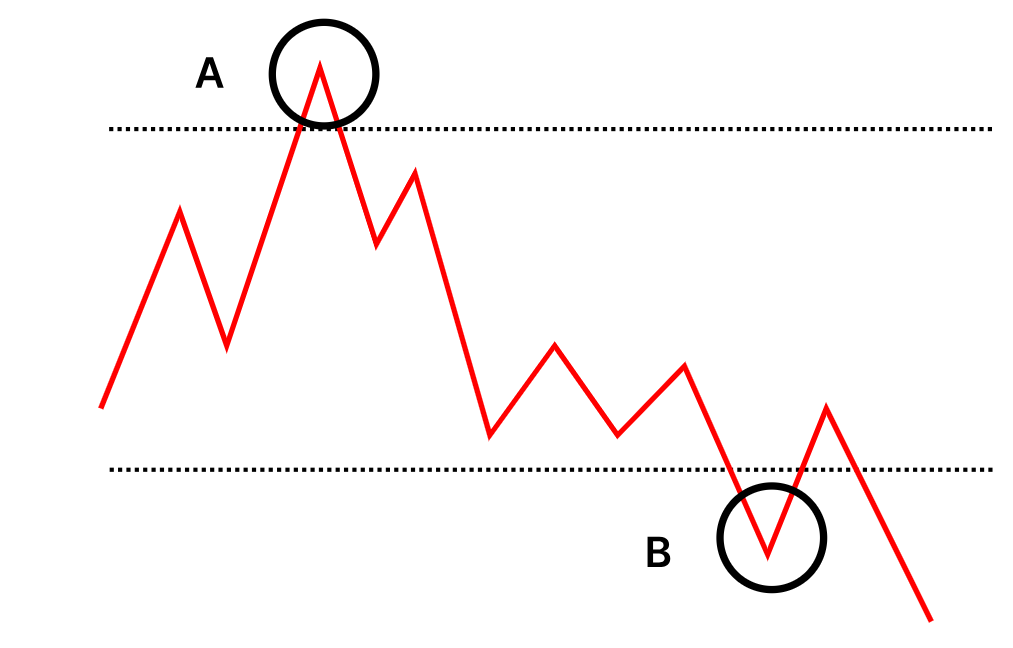

Reversal Trading Strategy

- Reversal trading, also known as pullback trade, involves betting on stocks to reverse price trends. Traders seek for equities that are at extreme highs or lows and expect them to reverse direction.

When the stock’s movement reverses, a stop is placed, and traders wait for the stock to reach a predetermined value. When the reverse value is reached, a transaction is executed.

- Reversal trading identifies changes in the cost of an asset direction and is used by day traders and long-term investors to determine whether to enter or depart the market.

Traders use trend lines, trading channels, and technical indicators such as moving averages (MA) and moving average convergence divergence (MACD) to identify reversals.

Momentum Trading Strategy

- Momentum trading uses the strength of price moves to open trades. Intraday traders look for stocks with daily movements, also known as momentum, and use stock scanners to find them.

The approach depends on the assumption that significant price movements will continue to attract additional traders and push prices higher until a large number of sellers trigger a decline.

- Momentum stocks frequently move over the Moving Average on significant volume. Traders select these stocks with the goal of achieving a 2:1 profit-to-loss ratio and holding them for varied amounts of time depending on market activity. This technique is most effective during high-volume early trading hours, providing huge profit chances for vigilant traders.

Gap and Go Trading Strategy

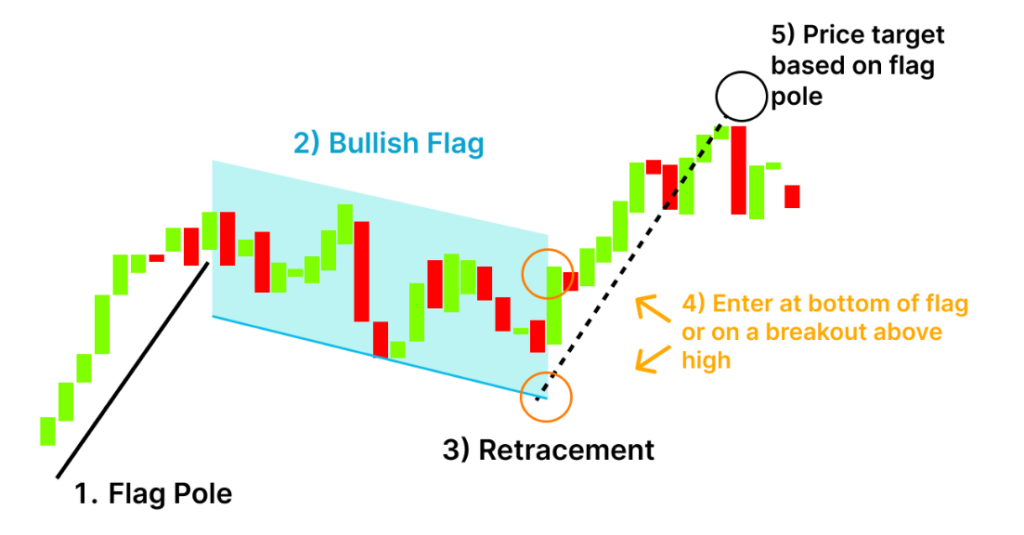

Bull Flag Trading Strategy

The bull flag pattern represents the continuation of an uptrend, which consolidates between parallel trend lines before breaking out and extending the trend. Bull flags, unlike bear flags in downtrends, indicate bullishness. They form after a big price movement (flagpole), with initial volatility followed by a pullback, resulting in parallel high and low patterns that take time to establish.

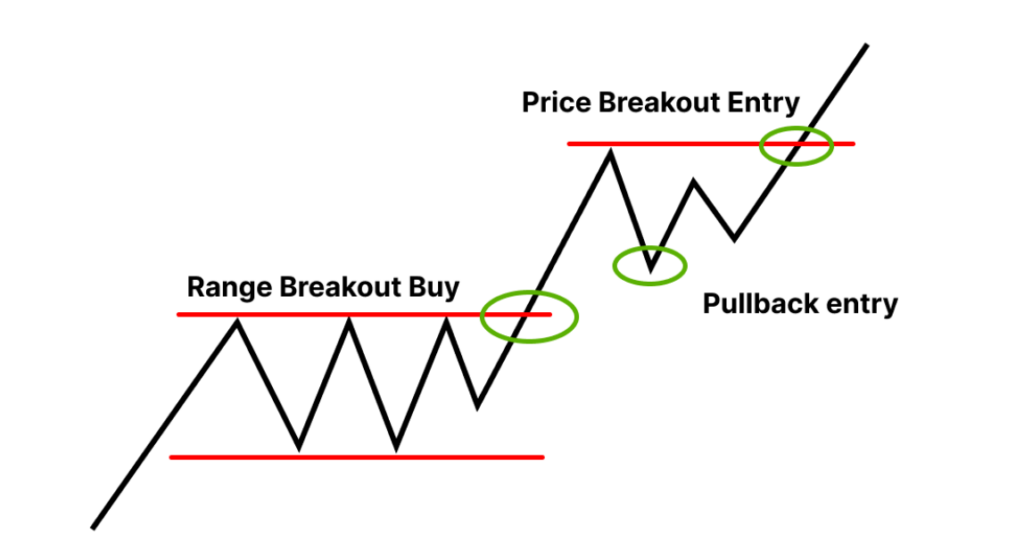

Pull back trading strategy

A pullback occurs when the price goes in the opposite direction of the long-term trend. The pullback strategy protects traders from losses during a trend. Trades strong stocks in large volumes.

Different from a trend reversal. In strategy, vulnerability is purchased, whereas strength is sold. Buy a pullback after the breakout. Lasts a few sessions; the reversal shows that market mood has changed.

Breakout Trading Strategy

Breakout strategy is entering the market when prices exceed resistance or support levels. Traders employ volume indicators to spot breakout patterns. Requires rapid entry and exit. Breakouts indicate strong market swings. This occurs when the price breaks out of its established range impulsively. Traders compute breakout prices, but this is dangerous because purchasing opportunities shrink following the breakout.

Candlestick strategy

Candlestick technique for intraday trading is evaluating candlestick patterns for predicting price movements for a single trading day. Traders use candlestick forms to discover buy and sell signals, as well as support and resistance levels, to help them make short-term trade decisions.

Hammer candlestick pattern

The hammer candlestick pattern approach is a bullish reversal pattern utilised in trading. It happens when a price falls dramatically after the open, but then rises to close near the open.

Traders perceive this as a potential upward turnaround, particularly when it occurs near the bottom of a downtrend. They may use it as a buy signal, expecting a positive trend reversal.

Bullish candlestick patterns

A bullish candlestick pattern method for intraday trading entails finding candlestick patterns that indicate possible price increases during a single trading day. Traders utilise these patterns to spot buying opportunities and forecast bullish trends, frequently combining them with other technical indicators for confirmation.

Bearish candlestick patterns

A bearish candlestick pattern method for intraday trading consists on finding candlestick patterns that indicate likely downward price moves during a single trading day. Common bearish patterns include the bearish engulfing pattern, evening star pattern, and shooting star pattern. Traders employ these patterns to identify selling opportunities and forecast negative trends, frequently confirming alerts with additional technical indicators.

Spinning top candlestick pattern

The spinning top candlestick pattern approach for intraday trading is identifying the spinning top pattern, which is distinguished by a small body and extended upper and lower wicks. This shows that buyers and sellers are unable to reach an agreement. Traders utilize this pattern to predict possible reversals or continuations of the present trend. They may seek confirmation from other indications before making trading decisions, such as volume or support/resistance levels.

J. single candlestick patterns

Single candlestick patterns are employed in intraday trading to assess price fluctuations that occur inside a single trading session. Traders use patterns such as doji, hammer, shooting star, and engulfing patterns to determine market mood and possible price movement.

These patterns can indicate the reversal or continuation of trends, allowing traders to make timely purchasing or selling decisions throughout the trading day.

Intraday Trading Tips

There are several tips for intraday trading that can help improve your success in the market:

- Before engaging in intraday trading, conduct a thorough examination of market conditions, company fundamentals, and macroeconomic indicators.

- To reduce financial risk, only trade with funds that you can afford to lose.

- Avoid overtrading by focusing on a small number of stocks at a time.

- Regularly review your trading performance in order to learn from both successful and unsuccessful trades.

- Use indicators wisely to maximize results in intraday trading.

Conclusion

Intraday trading allows you to boost your regular savings, but it demands careful analysis, discipline, and risk management. Understanding market trends, selecting good stocks, and implementing efficient trading methods are critical to success.

Whether using moving averages, reversal patterns, or breakout tactics, traders must be alert and adjust to shifting market conditions. Regular self-assessment and learning from both successes and failures are critical for ongoing progress. Intraday traders can increase their chances of success in the volatile world of intraday trading by adhering to strategic principles and judiciously leveraging indicators.

FAQs

What is intraday trading?

Intraday trading is the practice of purchasing and selling stocks on the same trading day in order to profit from short-term price fluctuations.

How dangerous is intraday trading?

Market volatility increases the danger of intraday trading. It is critical to identify and manage risks effectively.

How do you choose stocks for intraday trading?

Select stocks with medium-to-high volatility and substantial liquidity. Analyze trading volume, correlation with benchmark indexes, and market movements.

What are some of the most popular intraday trading strategies?

Popular trading tactics include moving average crossings, reversal trading, momentum trading, gap and go, bull flag, pullback, breakout, and candlestick patterns.

How can I limit my losses in intraday trading?

Set stop-loss limits, trade with money you can afford to lose, prevent overtrading, and evaluate your trading success on a regular basis.

Can a beginner succeed in intraday trading?

Yes, with dedication, practice, and ongoing education, beginners can succeed in intraday trading.

What are some important tips for intraday trading success?

Perform a thorough market analysis, use indicators judiciously, concentrate on a small number of stocks, and adjust to changing market conditions.