The stock market is the oldest and most traded instrument and requires tested stock trading strategies to earn high profits. A trader may use one or more strategies for effective trade. It all depends on the traders choice and stock invested in. The factors also considered in the stock trade are the trader’s lifestyle, personality and resources. The availability of resources is necessary for investment and regular stock trading.

As the trading strategies are important, they influence the trade. Traders with these decisions and plan their future course of action. Therefore, no trader can succeed in the stock market without putting into action the stock trading strategies. The article discusses the best stock trading strategies used for active trading with some light over the stock market.

Stock Market

The stock market is where shares are traded; that is, shares are purchased and sold by the buyers and sellers of the market. The shares of a company provide ownership to the trader listed on the stock exchange or over the counter. There may be several stock trading points in a country. A trader buys and sells the shares at the stock exchange. The stock exchange is part of the overall stock market. Stock trading is done through stockbrokers or using electronic trading platforms.

The stock market is not confined to shares or equities but trades in exchange-traded funds (ETFs), bonds and other derivatives of stock, commodities and currencies. The traded securities and the number of participants of such a market is enormous. To provide every trader with a fair price, there is a stock market where the dealers meet, interact, and make transactions. Earlier, the market was traded in physical form with proper documentation of the shares, but now the process is easy with digitalisation. Traders can trade electronically over their computers or other devices.

How does the stock market work?

The stock market is massive and acts as both primary and secondary markets due to strict regulations. It provides security and transparency to the traders with a regulated environment. Traders enjoy security and several options of financial instruments where they can invest and trade. The primary stock market allows the issue and sale of the company shares through Initial Public Offerings (IPO). Thus, raising capital from investors. In an IPO, the company divides itself into shares and offers them for public trading. The process, in return, generates capital. The stock market is where they are put for trading, the stock exchange being the facilitator.

The stock market manages liquidity, transparency, fair market play and a regulated market. With electronic trading, the stock market manages trade more efficiently. The company also offers shares through the right-issue and follow-on offers and can even buy back their shares. You can learn about how to start stock trading in detailed.

Moreover, the stock market exchange maintains news, updates, announcements and financial information through reports. These are easily accessible through the official website of the exchange.

Functions of the stock market:

- Fair trading and transparency

- Maintaining liquidity

- Price discovery

- Security and Validity of transactions

- Support to eligible participants

- Investor protection

- Regulation

Stock Trading Strategies

Stock trading strategies are the essence of stock trading; traders won’t enjoy stock trading without them. Moreover, the use of stock trading strategies increases the chances of correct market predictions and aids in managing the fluctuations. Here, we have discussed stock trading strategies that are pretty helpful in regular stock trading.

News Trading Strategy

News announcements on digital and social media platforms are the factors that help in deciding the future of the trade. An investor should be alert and quick to reach news that concerns the stock market or the shares invested. There are various kinds of news floating in the market. A trader needs to be skilled and have operational knowledge of the trade as the news travels fast on social media. The news should be checked and verified before any action is taken. Traders should be quick in taking judgement out of the news and trade accordingly.

Market expectation is also vital for making market decisions. The news should match the market expectations; therefore, market expectations are necessary when using a news trading strategy.

News releases may be genuine or fake, so traders must be aware of the financial market. Information flow is the need for stock trading strategies, and if that is predicted wrong, it could be a huge loss for the trader. With the use of technical tools, traders can forecast the market and thus act on the news. A volatile market needs a news trading strategy for future actions.

Benefits:

- Updates about the market

- Defined entry and exit strategy

- Trade opportunities

- Better trade decisions

Drawbacks:

- Overnight risks

- Requires expert skills

- Quick actions

- Complete market knowledge

End-of-day Trading Strategy

End of the day means to trade near trading for the day closes. A good trick used for stock trading strategies is when traders become active when they know the market changes and study the price fluctuations. The trader focuses on trading stocks and price movement for the previous day’s to get a perfect idea about the share price.

The indicators used by the traders help decide on the price actions and set a stop-loss, take profits and limit order to manage overnight risks. This is the risk management technique that would be useful for stock trading strategies. Traders can go for this strategy as this utilises less time and needs study of charts at opening and closing times.

Benefits:

- Saves time

- Suitable for most traders

- Use of indicators

- Study of charts

Drawbacks:

- Overnight risk

- Needs adequate study of charts

- Knowledge of market

Swing Trading Strategy

It is trading on both sides of the financial markets. The traders of the stock market mainly use a swing trading strategy. The trading process is simple with swing trading; traders buy the securities when they feel the price will rise and sell when the opposite happens. Thus, the traders take advantage of the market oscillations. It requires technical analysis and knowledge of the market; the charts and patterns are studied with analyses of the price movements. Once the trend of the market is known, traders can easily decide on their future actions.

Traders of the swing trading strategy have to identify the trends when there are changes in market supply and demand. The swing depicts the length and duration of the swing visible in the chart; if interpreted correctly, traders would be successful in their stock trade. These are the support and resistance that are profitably analysed for stock trading.

Traders of swing trading strategy should consider the dips and pull back to interpret the price of shares.

Benefits:

- Mostly used by traders

- Provides opportunities

- Chart and pattern study

- It helps in knowing the trend

Drawbacks:

- Ample research and study

- Overnight risks

Day Trading Strategy

Full-time professional trading is what we call day trading or intraday trading. The day trading strategy is used by traders who prefer trading during day time. They have the opportunity to take advantage of price fluctuations in-between the hours of market opening and closing. Traders minimise the risk of overnight trading by not leaving the position open for a day. Instead, they trade in the daytime with multiple positions. If the day trading traders follow a plan, they can generate good profit out of their investments.

In addition to this, traders should also study support and resistance levels and the previous day’s trade. Many stock trading strategies are there in intraday trading.

Benefits:

- No overnight risk

- Flexible trading hours

- Trading opportunities

- Limited intraday risk

Drawbacks:

- Requires disciplined traders

- Flat trades

- Market study in detail

Trend Trading Strategies

The trend of the market aids in predicting market changes and price movements. The study of market trends is significant for better trade. Traders analyse the market using trends to pre-determine the future of the price movements. There’s no fixed view for the market, and they change their viewpoints as per the market volatility. A strong trading platform with technical and fundamental analysis would be the best for precise trend analysis.

Study of trend analysis is not easy; the base knowledge and understanding are required for trading and deciding over the future of the price changes. Alertness and accurate idea of the market would be feasible as the trend keeps changing quickly. Traders, therefore, should be aware of the risks of the market.

Benefits:

- Unending trade opportunities

- Used by all traders

- Analysis the market

Drawbacks:

- Overnight risk

- Difficult to understand

- Changes quickly

- Requires depth knowledge of the market

Scalping Trading Strategies

Scalping is a trading style where the traders benefit from short term trades. Traders invest in small amounts for a short period to earn. They, at last, accumulate all the profits and have a high profit. The scalping strategy of the stock market would be successful only when traders have a disciplined exit strategy. They take the profits before the market changes and observe the price changes closely. Operating on a risk/reward ratio of 1/1, traders do not go for long profits and increase the small number of investments that could earn profits.

Benefits:

- Mostly preferred strategy

- No overnight risk

- Trading opportunities

- Disciplined traders

Drawbacks:

- Limited markets

- Stressful

- Small profits

Position Trading Strategy

One of the stock trading strategies that is used widely for long term trade. Traders hold the position in the market for long periods of time. Depending on the trade, it could be a year or a monthly trade. The traders ignore small profits and minor price fluctuations for high profits. Using the fundamental analysis to study the market trends for potential opportunities, traders can also go for other factors that influence the trade.

Benefits:

- Increased profits

- Less stress

- Long term market position

Drawbacks:

- Losses

- High risks

- Swap

Growth Investing Strategy

The stock trading strategies are several from small to big, and one of them is growth investing. The companies focus on the growth of the capital and reinvest the profits earned. They only increase the profits and provide no dividend or any other benefit to the firm’s investors.

Short Selling Strategy

Going short means selling the stock that is borrowed for a short sale. The traders sell the borrowed shares further for a small profit and repurchase them when they feel that the stock price would increase—a good opportunity for small sales of stocks and earning profits.

Reasons to use Stock Trading Strategies

The stock market is a volatile market that keeps changing. To control and manage such fluctuations, traders use stock trading strategies. The stock trading strategies help in:

Verified strategy

Traders of the stock market have to deal with so many changes, and if the used strategy is wrong, then failure is fixed. To avoid such situations, verification of the stock trading strategy and its use should be studied before using it.

Consistency

Stock trading strategies maintain the consistency of trade; traders are focused and know their goals.

Objectivity

The traders sometimes overtrade and incur losses. To handle such situations and manage the trade, objectivity is necessary. Therefore, the stock trading strategies will enhance trade and provide more trade opportunities.

Best Online Stock Brokers

Stockbrokers are significant for stock trading and use stock trading strategies. The process of trading in shares is difficult if done without any guidance. Proper knowledge and understanding of the market are must to be profitable in the market. Professional traders even go for reputed brokers to enhance their trade. The brokers simplify the trade with their individualised trading accounts, customisable trading platforms and education. All these factors guide the professionals and beginners of trade.

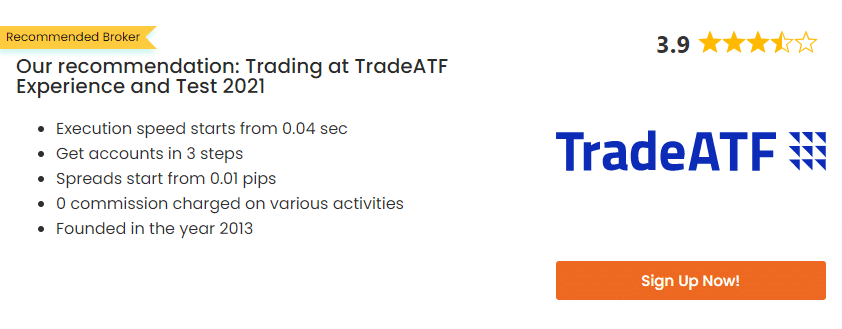

Traders can go for brokers like ROinvesting, 101investing, TradeATF and ETFinance. The brokers have all the facilities and services that traders require for a safe and advanced trade. All the brokers mentioned are reputed and regulated by a recognised authority. Moreover, they make the trade worth the investment with spreads, leverage and easy payment methods.

Conclusion

Stock trading strategies are essential for a profitable trade. The stock market is massive and is complicated if not used with proper aid. The stock trading strategies are aid that traders need for accurate decisions. Trade, if not incurs double the investment profits, then it’s useless to invest. To manage and control market trade trading with strategies and plans is a need. Traders can not go for long without the use of stock trading strategies.

The strategies like swing trading, scalping, day trading, position trading etc., are highly preferred in trade. This is because they help in better decisions and prediction of the market. Thus, managing the situation of price change and any other kind of fluctuation.